Back in July last year, I wrote about the dangers of the European Commission insisting on too high a threshold for airlines retaining their slots this winter (October 2021-March 2022). At the time, the Commission was proposing a 60% use-threshold to retain slots, instead of the normal 80%. Seeing the volatility in passenger demand—almost solely owing to government-imposed travel restrictions—we argued for greater flexibility and a vastly lower threshold. At the same time other regulators extended much more comprehensive slot alleviation rules for the Winter. The EC ultimately reduced the threshold to 50%.

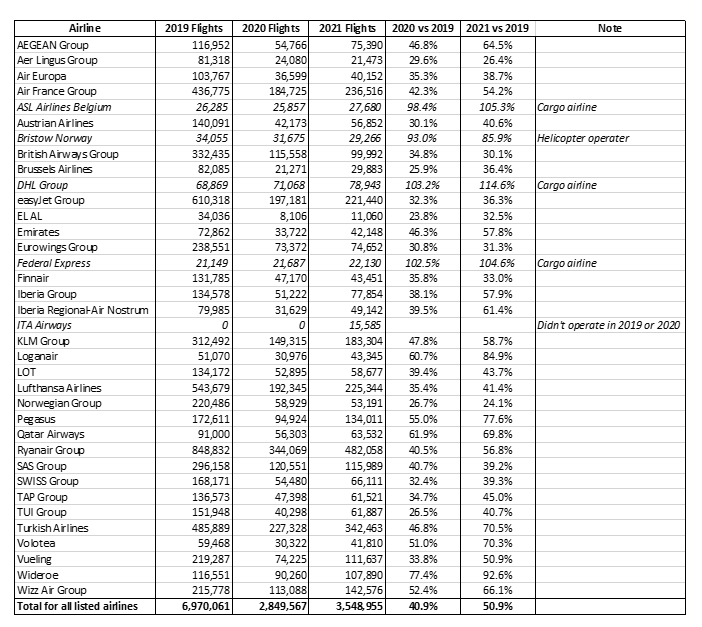

Data from Eurocontrol (Daily Traffic Variation - AOs (eurocontrol.int)) has been invaluable during this crisis and shows the extreme nature of the impact of the virus on airlines. In 2021, the 36 airlines listed in the data collectively operated just 50.9% of the flights operated in 2019. The figure for 2020 was only 40.9%. All the passenger airlines listed showed significant reductions in their schedules and availed of the slot alleviations offered by the Commission. I have included a summary chart of the Eurocontrol data for your benefit.

In normal times, many airports don’t have enough capacity to meet demand for connectivity at all times of the day. In Europe almost 200 airports have either full or partial slot restrictions. Slot allocations at these airports distributes scarce capacity under agreed rules that preserve competition, serve consumer interest and enable airlines to make long-term fleet and market development decisions. Huge amounts of planning, precision and investment go into building the networks that enable global connectivity. Losing slots is untenable even in the best of time, impacting an airlines scale of operations and the economy and society in which it operates. At this juncture it will also shape how the airline recovers from the crisis. Some airlines operate large parts of their network from airports that don’t have slot restrictions which clearly gives these airlines greater flexibility with their flights.

But nobody could have foreseen what was to come with Omicron.

The lengths that carriers will go to defend their slots was demonstrated when, last week, Lufthansa CEO Carsten Spohr warned that Lufthansa Group was facing the prospect of 18,000 unnecessary flights to keep its slots under current European rules.

Hearing this, Belgium’s transport minister asked the Commission to review. Rightly so. In the face of wobbling passenger demand, a labour force that is suffering with Omicron infections, and constantly changing travel rules, flexibility in excess of what is currently being offered is critical.

Ideally, we need the same business conditions for airlines in Europe as regulators have granted in other jurisdictions. This is particularly true for airlines with large global networks. That can be achieved without a full slots waiver if the exceptions are reasonable and recognize extraordinary demand situations like we are seeing currently in Europe.

The current regulation releases airlines from fully utilizing their slot series when there are travel bans and hard restrictions. However, the situation is more complex for airlines operating a hub business model. In this case, if a travel ban prevents the airline from operating a long-haul international flight it would also significantly impact on the passenger demand for many of the connecting short-haul flights. In some cases, up to 80% of the passengers on a long-haul flight could originate at another airport. For example, a passenger flying from Brussels to Delhi, via Frankfurt won’t want to fly to Frankfurt if the flight to Delhi is not operating because of Government restriction on flights to India.

We are asking the Commission to find ways to accommodate in that flexibility the commercially unviable low demand that can result from these decisions. This is a reasonable ask and certainly sensible. To their credit the Commission has been helpful and pragmatic in dealing with these issues during this crisis. Using all the flexibility that existing rules allow would level the playing field for Europe’s airlines, enabling them to make rational and sustainable schedule decisions. Where there’s demand they will fly.

To do that, however, the Commission needs to look at measures of real demand. Currently, it references Eurocontrol statistics, which as I have said, have proven to incredibly valuable, but can show a much more optimistic situation than airlines are experiencing. That is because Eurocontrol numbers are purely about aircraft movements and not the load they are carrying. That does not accurately illustrate the demand for connectivity that airlines see in passenger numbers and forward bookings. But I would add that the situation is currently so challenging that even the latest Eurocontrol numbers describe a “freefall” of flight movements.

Enforcing that only hard bans and travel restrictions are eligible to justify non-use of slots in current circumstances could do significant damage. Unsustainable near-empty flights do unnecessary harm to the environment and airline finances. And losing slots forfeits years and decades of investment to build the efficient global networks that serve Europe’s shippers and travelers.

Policy will be hard pressed to evolve with the speed of the pandemic, which is why flexibility is core of what we are asking of the Commission (and all governments). That will allow airlines to react to markets conditions without taking a long-term penalty on their networks.

Industry insiders know that pre-crisis the Commission’s slot policy was often heralded as industry leading. In fact, it was a guide for many governments even outside of the EU. But today, global regulators are turning a blind eye to what Brussels is doing with slot rules. The EU can regain some leadership with a simple fix, accepting exceptionally low demand as a temporary justification for not meeting the threshold to keep slots. With the twists and turns of the pandemic changing business reality day-to-day, such flexibility is the key to ensuring that Europe will have a strong global air transport network to energize its economic recovery.