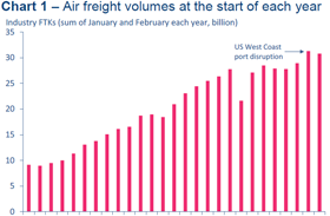

Geneva – The International Air Transport Association (IATA) released data for global air freight markets showing air cargo volumes (measured in freight tonne kilometers or FTKs) suffered a 5.6% fall in February compared to February 2015. This is heavily skewed due to the impact of the US port strikes in early 2015 (which caused a spike in air freight) and Lunar New Year falling in February this year. Comparing January and February 2016 performance to January and February 2014 reveals 6.3% volume in growth—equal to a 3.1% annualized growth trend.

“The air freight business remains a difficult one. February’s performance continues a weak trend. And there are few factors on the horizon that would see this change substantially. In the absence of an imminent resurgence of demand, the importance of improving the value proposition with modernized processes—the e-freight vision—remains a top priority,” said Tony Tyler, IATA’s Director General and CEO.

| February 2016 (% year-on-year) | World share (1) | FTK | AFTK | FLF (%-pt) (2) | FLF (level) (3) |

|---|---|---|---|---|---|

| Total Market | 100.0% | -5.6% | 7.5% | -5.7% | 41.0% |

| Africa | 1.5% | -1.7% | 26.2% | -7.1% | 35.7% |

| Asia Pacific | 38.9% | -12.4% | 3.7% | -8.5% | 46.2% |

| Europe | 22.3% | -2.4% | 7.3% | -4.4% | 44.6% |

| Latin America | 2.8% | 2.7% | 8.4% | -1.9% | 34.6% |

| Middle East | 14.0% | 3.7% | 12.3% | -3.4% | 41.0% |

| North America | 20.5% | -4.0% | 8.0% | -4.2% | 34.0% |

(1) % of industry FTKs in 2015; (2) Year-on-year change in load factor; (3) Load factor level

Regional Analysis in Detail

African airlines’ FTKs declined by 1.7% in February compared to February 2015. The largest economies in the region, Nigeria and South Africa, have suffered from the commodity slump over the past 18 months.

Asia-Pacific carriers, which carry almost 39% of all air freight, saw FTKs contract by 12.4% year-over-year in February. While this was the largest drop of any region, it also reflects the region’s carriers having benefited the most from the 2015 US port strike. And the region’s weak trading backdrop was exaggerated by the closure of many factories in Asia for the Lunar New Year Celebration. In February Chinese export values fell 25%.

European airlines’ demand fell by 2.4% in February. Business surveys of the region, particularly in Germany, do not give an upbeat assessment of prospects in the region. This is in line with the trend since the Global Financial Crisis: European freight volumes are barely any higher than in 2008.

Latin American carriers expanded by 2.7% in February. Markets in the region remain under pressure and Brazil is in its worst recession in 25 years. Volumes on the North-South American routes, however, are holding up.

Middle Eastern carriers were able to continue their consistent growth trend despite the statistical noise, expanding 3.7% in February. Over the past six months the major carriers in the region have cut their rate of route expansion, which may account for the relative slowdown in freight volume growth.

North American airlines saw FTKs fall 4.0% in February compared to February 2015. Looking ahead, the prospects for cargo growth will depend on the balance between a stronger domestic economy supporting import growth and a strong US dollar dampening exports.

View full February freight results (pdf)

Corporate Communications

Tel: +41 22 770 2967

Email: corpcomms@iata.org

Notes for Editors:

- IATA (International Air Transport Association) represents some 260 airlines comprising 83% of global air traffic.

- All figures are provisional and represent total reporting at time of publication plus estimates for missing data. Historic figures may be revised.

- You can follow us at www.twitter.com/iata2press for news specially catered for the media.

- Explanation of measurement terms:

- FTK: freight tonne kilometers measures actual freight traffic

- AFTK: available freight tonne kilometers measures available total freight capacity

- FLF: freight load factor is % of AFTKs used

- IATA statistics cover international and domestic scheduled air freight for IATA member and non-member airlines.

- Total freight traffic market shares by region of carriers in terms of FTK are: Asia-Pacific 38.9%, Europe 22.3%, North America 20.5%, Middle East 14.0%, Latin America 2.8%, Africa 1.5%.