Need Help?

The IATA Aviation Carbon Exchange, or ACE, is a centralized marketplace for CORSIA eligible emission units where airlines and other aviation stakeholders can trade CO2 emission reductions for compliance or voluntary offsetting purposes. A secure and easy to use trading environment, ACE offers the highest transparency in terms of price and availability of emissions reductions.

Airlines trading on ACE benefit from the IATA Settlement Systems and Clearing House for seamless and risk-free settlement of funds. The exchange is open to all airlines, IATA and non-IATA members, and other aviation stakeholders including airports and aircraft manufacturers. Furthermore, the exchange is also accessible to carbon market participants wanting to list emissions reduction that are CORSIA compliant.

The ACE platform is offered in partnership with technology provider Xpansiv, a global market leader for ESG-inclusive commodities. The ACE is in operation since 2020 with more than 20m tonnes of carbon credits having been traded on the exchange since then.

Need Help?

Need Help?

The ACE was designed to provide a centralized marketplace where airlines can identify, select, and transact voluntary and CORSIA eligible emission units, via a simple, secure electronic interface. At present, more than 50 airlines have made voluntary net zero offset commitments, and the ACE and its easy-to-use trading environment allow for the sourcing of carbon credits to meet their individual commitments.

Powered by CBL, an Xpansiv market, ACE will serve as a centralized marketplace for CORSIA eligible emission units, providing a secure, intuitive destination for airlines to access real-time data with full price transparency. ACE trading is supported by the well-established IATA Settlement System and Clearing House, offering a seamless and risk-free settlement to IATA and non-IATA airlines.

ACE is open for trading to all airlines and carbon market participants, acting as buyers or sellers.

In particular, ACE will be useful to:

- IATA and non-IATA member airlines

- Aviation stakeholders, e.g., airports, aircraft and engine manufacturers, ground handling operators

- Banks and commodity trading companies

- Carbon offset broker and retailers

- Carbon offset project developers

- Active carbon market participants

All emissions units are being vetted for CORSIA eligibility before units are listed on the exchange.

Airlines and carbon market participants can request access by contacting us at ace@iata.org.

- Access: CORSIA-eligible emission units accessible via one dedicated screen

- Simplicity: Easy-to-use electronic interface, with filter functions and selection by

- Secure Trading: Electronic clearing and minimal settlement time and delivery of products and funds, eliminating counterparty risk

- Leverage: Trade directly with a wide range of participants (including brokers, intermediaries, project developers) removing the need for ERPAs

- Increased Liquidity: The exchange provides price transparency and liquidity across multiple compliance markets

- Connectivity: Electronic interfaces with registries to facilitate seamless trading of:

- Safe & Secure Settlement: Seamless and secure in-fund trading for airlines using the IATA Invoicing and Clearing House system.

- Marketplace Trading: Possibility to switch between marketplaces, e.g. between dedicated CORSIA-eligible emissions market and other markets that fulfil mandatory offset obligations or voluntary offsetting demand.

- - project type

- - state/region

- - standard, or vintage

- - link to project information

- - American Carbon Reserve (ACR)

- - Climate Action Reserve (CAR)

- - Gold Standard (GS)

- - Verified Carbon Standard (VCS/Verra)

- - Environment Management Account (EMA)

ACE EEU Volume Procurement Events

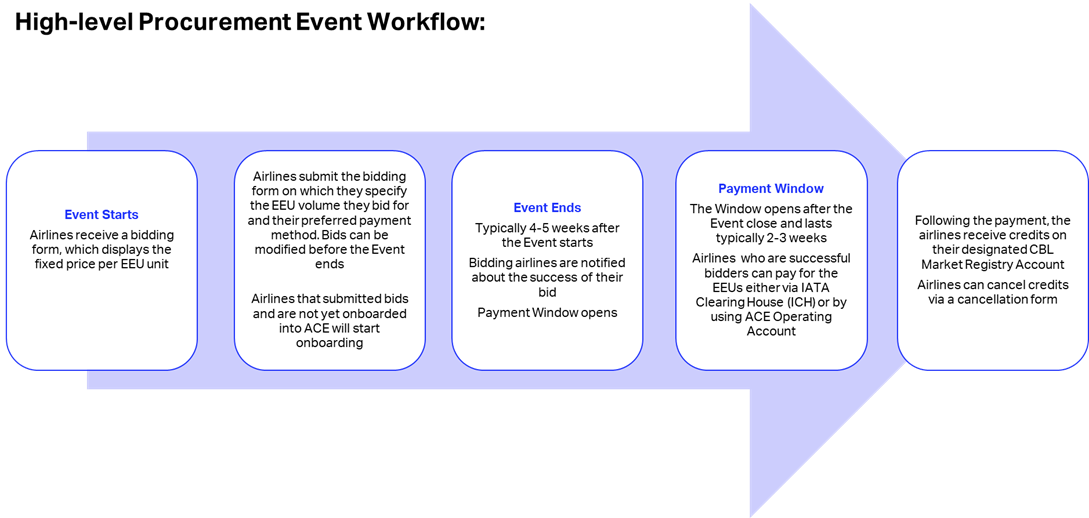

In 2025, the International Air Transport Association will host quarterly CORSIA EEU (Eligible Emissions Units) procurement events exclusively for airlines on the IATA Aviation Carbon Exchange (ACE) platform.

These events facilitate the purchase of emissions units to support airlines in meeting their CORSIA (Carbon Offsetting and Reduction Scheme for International Aviation) compliance requirements. Each event may feature different project developers, resellers, dates, fixed-price and volumes of EEUs sold.

Mechanism of Procurement Events

- Event Hosting and Organization:

The virtual procurement events are hosted on the IATA ACE Platform and organized by IATA, the technical provider of the ACE platform Xpansiv, various project developers, resellers and States. The duration of these events typically spans over four to five weeks. - Bidding Process:

Airlines submit bids via an online Bid Submission Form during the event duration. The form displays the fixed price of EEUs/tonne. The units are allocated on a first-come, first-served basis according to the bid submission date after the event closes. Bids can be modified or cancelled during the event duration. - Payment and Settlement:

Following the end of the event, airlines whose bids were successful can pay for the EEUs via the IATA Clearing House (ICH) or ACE Operating Account. The payment window opens shortly after the event closes and typically spans over two to three weeks.

Additional transaction options may be possible. They will vary from event to event, and include an option for future delivery with deferred payment terms or immediate settlement following the submission of the bid. - Credit Transfer and Cancellation:

Following the payment, EEUs are held in the airline’s designated CBL Market Registry Account (CBL is a global exchange platform operated by Xpansiv). Alternatively, EEUs can be held in the airline’s own registry account if this airline has an existing registry connection.

Cancellation: Credits can be cancelled for CORSIA compliance via a cancellation form if the EEUs are held in the airline’s designated CBL Market Registry Account. An airline holding its own registry account can cancel the EEUs autonomously within the ACE platform. - Participation and Eligibility:

The events are open to airlines only. To claim successful bids, airlines must be onboarded to the ACE platform before the event closes. The onboarding process for procurement events is simplified compared to full membership ACE onboarding. For instance, an airline does not need to have an existing carbon registry connection. A comparison between the features of full ACE Full Membership and ACE Procurement Event Access only can be found here.

Example of historical Procurement Event:

Q4 2024 Procurement Event organized by IATA, Xpansiv, Mercuria and the State of Guyana.

- Project Developer: Government of Guyana

- Reseller: Mercuria

- Event Dates: 28 October 2024 – 29 November 2024

- Volume: 1 million tonnes of CORSIA Phase 1 eligible emissions units from the Guyana Jurisdictional REDD+ Program

- Fixed price: $21.70/tonne

- 32 airlines expressed interest of which 11 purchased the EEUs

For more information on upcoming procurement events and how to participate, please contact ace@iata.org.

Please fill in the webinar form to request a dedicated demo for you and your colleagues. The demo will cover the basic ACE functionalities and explain in detail how the system can help you with your CORSIA offset compliance requirements.

What is the ACE?

Description of the ACE

The IATA Aviation Carbon Exchange (ACE) is a centralized marketplace where airlines and other

aviation stakeholders can trade CORSIA eligible emission units, as well as emission units for

voluntary offsetting purposes.

The ACE provides a secure, intuitive destination for airlines to access real-time data with full

price transparency. A secure and easy-to-use trading environment, the ACE offers the largest

pool of available emissions reductions within carbon markets.

The exchange is open to all airlines (IATA and non-IATA) and carbon market participants

seeking to trade voluntary emissions reduction units, as well as those that are CORSIA

compliant.

Airlines trading on the ACE will benefit from IATA’s Simplified Invoicing and Settlement (SIS)

and IATA Clearing House for seamless, risk-free settlement of funds.

The ACE platform is offered in partnership with Xpansiv CBL Holding Group (XCHG), and

is powered by CBL Markets (CBL), an XCHG company. The exchange will be rolled out in a

phased approach, in terms of trading options, with full integration into the CBL trading platform

and IATA’s settlement systems expected during the fourth quarter of 2020.

What is CBL Markets?

CBL, an Xpansiv Market, provides access to the world’s energy and environmental commodity markets, facilitating the secure and seamless trading of commodities like carbon, renewable energy, water, and gas.

Since its inception in 2009, CBL has operated the only exchange marketplace for third party verified voluntary carbon offsets registered and issued by recognized standards, including:

Why is the ACE necessary?

- The ACE provides a trusted, proven venue for airlines to meet voluntary goals and CORSIA

obligations. The ACE will simplify navigation of the carbon markets and help participants save

time and money. - The ACE removes financial and compliance risks for airlines by ensuring that they are

investing in CORSIA eligible emission units - The ACE reduces financial risk for airlines as they invest in a low-carbon future.

- The ACE will act as the catalyst and channel where carbon offset project developers and

carbon market participants have direct and instant market access to airlines and other

aviation stakeholders. - ACE reduces the costs and administrative burden of contracting parties and removes the

need for agreements typically needed when buying carbon offsets (e.g. ERPAs)

What are the benefits of the ACE?

- Access: All CORSIA-eligible emission units are accessible from one screen.

- Simplicity: Easy-to-use, single-venue interface:

o Select by project type, state/region, standard, or vintage

o Links to detailed project information direct from trading screen - Secure Trading: Electronic clearing and minimal settlement time and delivery of products and funds, eliminating counterparty risk.

- Extensible: Trade directly with a wide range of participants (including brokers, intermediaries, and project developers), removing the need for ERPAs.

- Increased Liquidity: The exchange provides price transparency and liquidity across multiple compliance markets.

- Connectivity: The exchange electronically interfaces with registries to facilitate seamless trading of products:

o American Carbon Reserve (ACR)

o Climate Action Reserve (CAR)

o Gold Standard (GS)

o Verified Carbon Standard (VCS/Verra)

o UNFCCC Clean Development Mechanism (CDM) - In progress - Safe and Secure Settlement: Seamless in-fund trading for airlines using IATA’s Simplified Invoicing and Settlement (SIS) and Clearing House (ICH) system.

- Marketplace Trading: Easily select between marketplaces, e.g., between dedicated CORSIAeligible emissions market and other markets that fulfill mandatory offset obligations or voluntary demands.

How to Join the ACE

Who can join? Is ACE only available for airlines?

ACE can be accessed by all airlines and carbon-market participants, acting as buyers or sellers.

Access can be requested by:

- IATA and non-IATA member airlines and all other aviation stakeholders (e.g. airports.)

- Banks and commodity trading companies

- Carbon offset brokers and retailers

- Carbon offset project developers

- Active carbon market participants

Where to join?

- To join the ACE, interested parties first need to register and finalize the application process.

- Upon approval, ACE participants can access the trading platform through the portal.

How long does the onboarding process take?

Typically, ACE onboarding takes 2–3 weeks. The pace is predicated on the applicant providing the requested application documentation.

What type of documentation is required for access to the ACE?

Airlines applying to participate in the ACE already have an account with IATA, but will also need to submit an application to CBL by visiting the portal at https://ace.iata.org. All applicants will need to provide:

- Company information

- Designated authorized representative(s) information and access level

- Registry account information, or if you’re not already connected to a registry, you will be able to select registries ( Sections 4.9 and 4.10)

- Depository bank account information

- Certificate of incorporation

- Copy of valid passport or driver’s license for whomever is signing

- Evidence of authority to sign on behalf of the applicant

Are CBL members automatically given access to the ACE?

- No - members of CBL who would like to participate in the ACE can request access to the CORSIA marketplace via an abbreviated application.

- IATA will review each request and if approved, CBL members will be granted access to a CORSIA-specific workspace on the CBL Markets screen.

Are IATA members we automatically given access to the ACE?

- No - the ACE is a secure trading environment in which all participants have been reviewed by both IATA and CBL by providing all necessary documentation, including KYC and AML information (Section 2.4).

- As such, members of IATA must apply for access at https://ace.iata.org.

- Once all necessary information for registration has been accepted, an email will be sent with further instructions.

- IATA members will be granted free access to the ACE.

Can I join as a non-ICH member?

Yes - interested parties can visit https://ace.iata.org for instructions to apply for participation.

What are the fees to join the ACE?

- The ACE is free to join for airlines.

- For all other participants, the annual membership fee is $2500/annually.

- If participants are not already connected to standard registries, there are fees associated with joining different registries (Section 4.5).

- CBL can facilitate connection with different registries, as indicated on the ACE Participant Application. The fee per registry is listed in Section 4.5.

- Once connections are established, CBL will set up an Environmental Management Account (EMA) account as part of our service. The EMA aggregates registry information for participants to view and manage all registry activity in one place (Section 5).

Trading on the ACE

What do you charge to trade on the ACE?

- ACE does not apply a mark-up on the price of carbon but rather a fixed transaction fee per single unit. A unit equals to one (1) carbon credit representing one (1) tonne of CO2. We feel by applying a fixed fee per unit provides for highest cost transparency and consistency.

- The standard transaction fees charged by CBL are $0.05 per unit paid by the buyer, thus if a unit is listed for $1.00, this will result in a net cost of $1.05.

Is there a minimum volume of trading we are obligated to meet?

- No, but participants are encouraged to use the ACE to transact offset purchases for both voluntary and CORSIA-related offsetting; the ACE will only be as robust and useful as it is envisioned to be with high activity.

- The minimum volume on any given trade is 100 units.

What are the ACE market hours?

The market will be open 23/7/365. There will be a maintenance period break once a day and that break is currently TBD.

What currencies are supported by the ACE?

Currently, only USD will be supported by the ACE. As the program expands, additional currencies will be added.

How do I initiate a trade or purchase?

Please refer to the Step-by-Step Training Guide that will be provided upon acceptance to the ACE for instructions on how to initiate a trade or retire credits.

Where can I see what I’ve purchased or retired/cancelled? What is the difference between retired and cancelled?

- Retirements and cancellations are often used interchangeably. Carbon-market participants more commonly use “retirement,” while the states and ICAO more commonly use “cancellation.” For the purposes of this document, we will use both as a reference to the offset unit being removed from further circulation or accounting.

- Your purchase and retirement/cancellation activity can be found in the Environmental Management Account (EMA) or in your individual registry accounts (Section 5).

Will there be any specific training?

- There will be ongoing webinars to train participants on how to use the ACE

- Please refer to https://ace.iata.org for a list of scheduled webinars, or submit your information to ace@iata.org to be added to our mailing list with updates on upcoming events, trainings, and information

- Participants can follow the Step-by-Step Training Guide, which will be sent in your onboarding email

- Participants can also schedule a training for their company by emailing ace@iata.org

CORSIA Eligible Programs or registries, and Eligible Units

What is the difference between a standard, a registry, and a program?

- “Registry” is a centralized database where the entire lifecycle of a carbon credit is recorded from issuance to transfer(s), to eventual retirement. The registry contains detailed information about individual projects including project design, geographic/activity boundaries, monitoring and reporting systems, quantifications, verification, and credit issuance. Most registries also offer user accounts to track emission units as they are transacted from seller to buyer.

- “Standard” in the context of ICAO/CORSIA refers to a governance body that applies an established framework for developing, measuring, and verifying greenhouse gas emission reduction activities. Standards bodies typically organize expert peer review and eventual validation and publication of accepted methodologies that guide a project’s development and implementation. Emission reduction projects are subject to stringent third-party verification to ensure that the reported emission reductions are real, permanent, additional, and verifiable. Offset credits are issued after a project has been validated by the standard and has passed the third-party verification. Once issued, the offset credits are registered and become available in environmental markets.

- “Program” is used by ICAO to refer to the entities that have been approved to provide CORSIA-eligible units. In the context of ICAO/CORSIA, a Program is synonymous with a “Standard”. All Programs/Standards manage a registry where emission units can be issued, transferred and eventually retired.

How do I connect to a registry?

- On the ACE Participant Application, Exhibit C, applicants can select which registries they wish to connect to. We recommend connections to all registries to allow for the broadest possible trading options (participants can only view and purchase units from registries for which they have an account)

- CBL can facilitate setting up connections, and participants pay the registry set-up fee (Section 4.5)

- As part of its service, CBL will activate an Environmental Management Account for all participants (Section 5)

- If a participant already has an account with a registry, simply input the account information in

the ACE Participant Application, Exhibit C, and CBL will link the accounts

How much does it cost to connect to a registry?

Each registry independently charges its own set up and annual maintenance fee, separate from the ACE. Participants can elect which registries to join, but we recommend connecting to all registries to allow for the broadest possible range of trading options. CBL can facilitate opening the registry accounts if indicated on the participant application. Prices as of today’s print are listed here:

| Registry | Setup Fee (USD) | Annual Maint. Fee |

| American Carbon Registry | $500 | $500 |

| China GHG | N/A | N/A |

| Clean Development Mechanism (CDM) | N/A | N/A |

| Climate Action Reserve | $500 | $500 |

| The Gold Standard | $1,000 | $1,000 |

| Verified Carbon Standard | $500 | $500 |

What are the criteria for CORSIA Eligible Emissions Units?

The eligibility criteria can be found on the ICAO website here.

Who is responsible for reporting offset retirements/cancellations?

Airline operators will report to their national state administering authority (eg., CAAs, ministry of environment, etc.) their emissions units cancellation report. Before sending the report to their states, operators must have engaged with and independent and accredited verifier to have audited and certified the report. The verifier will audit the volumes, eligibility, and cancellations of emissions units. The exchange provides connectivity to registry account. After each trade, units will be available in the registry account for airlines.

Environmental Management Account

What is the Environmental Management Account (EMA)?

EMA provides a definitive solution to the challenges of managing an ever-growing portfolio of environmental assets. By intelligently linking portfolio positions residing on different environmental registries into a single access point, EMA accountholders can view, analyze, report, monitor, and manage an entire CORSIA or voluntary carbon inventory within a single account structure. The result is increased productivity while reducing administration and tracking costs. EMA allows you and your team to focus on core competencies.