Currency repatriation is a crucial aspect of treasury for companies, such as airlines, that operate in a global industry. With operations spanning multiple countries, airlines face unique challenges in managing their finances, including repatriating revenue, dealing with exchange rate fluctuations, and complying with diverse regulations.

What are blocked funds?

As per the annual Remittance Foreign Balance survey (RFB) and definition agreed for the industry, the Blocked Funds Countries are recognized when the airlines face delays on funds repatriation for which remittance applications have been outstanding for more than 2 months for reasons beyond their control, such as unreliable procedures to obtain repatriation various restrictions imposed by Governments or Central Banks, shortage or lack of foreign exchange and more. Such markets call for stronger lobby actions.

Blocked Funds markets overview

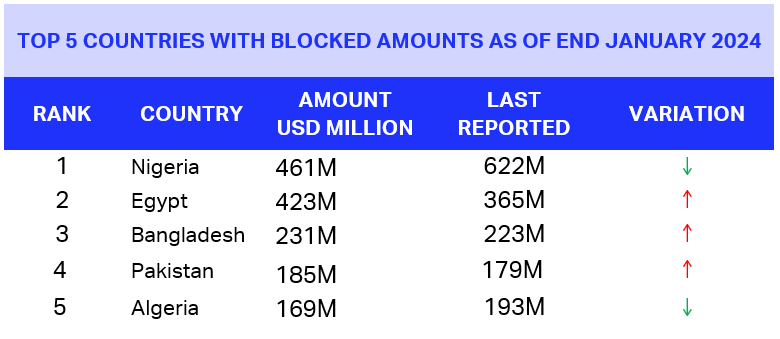

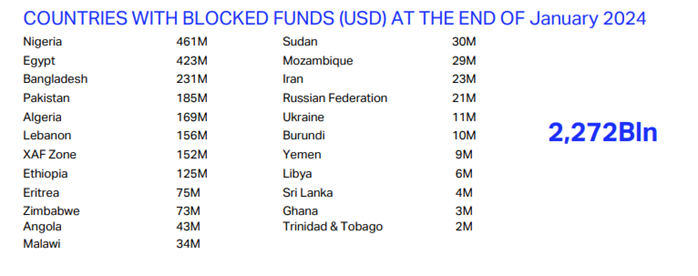

While currency volatility remains a prominent concern, the amount of blocked funds within the industry improved slightly over the last months due to allocations in Nigeria, and accounts for approx. $2.27 billion in end-January (vs. $2.5B at end-Dec). IATA remains committed to advocating for the aviation sector's interests across countries affected by these fund blockages and is actively refining its strategic approaches to address these challenges more effectively.

Nigeria: Due to strong and successful lobby efforts of IATA’s local teams, as well as airlines’ data reporting playing a critical role, a significant backlog’s settlement (-36%) by the Nigeria Central Bank and commercial banks was observed in 2023. By end-January, Central Bank cleared all the verified airlines’ outstanding backlog, leading to only 6% of current blocked funds held with Central Bank and the remaining 94% with commercial banks expected to be traded on Nigerian money market (NAFEM).

Egypt: Due to an important increase in sales, effective 10th January 2024, the CAA restricted all sales out of Egypt except for tickets that originate from Egypt. In February, Egypt has signed a USD35B deal with the UAE which was expected to ease the repatriation issues. In early March, the Central Bank announced a float of EGP which resulted in liquidity availability bringing a significant movement of clearing airlines’ ICCS backlog.

2023 blocked amounts cleared

Relaying on airlines’ blocked funds data reported and with strong leadership of IATA’s Regional Teams and support of IATA’s operational teams, IATA has helped to clear over $4.5B in blocked funds in 2023, and the efforts do not cease.

IATA continuously, thought its advocacy activities, urges governments to abide by international agreements and treaty obligations to enable airlines to repatriate these funds arising from the ticket sales, cargo services, and other ancillary sources across various countries. This involves addressing issues related to foreign exchange controls and advocating for policies that support the free flow of funds across borders.

In order to have a complete picture of the difficulties faced by our Members and to both, support the advocacy efforts and communicate to the Airline Members the latest information, airlines’ collaboration is essential. Through the IATA Currency Center, Airlines are kindly asked to complete the monthly blocked funds survey by reporting the latest status of their outstanding amounts and report any new repatriation issue they are facing.

This reporting is at the base of all the currency repatriation activities including advocacy efforts.

IATA Currency Center

The Currency Centre is a free of charge tool for IATA Members and it is accessible via the IATA Customer Portal.

This dynamic online information tool provides currency information from an economic and financial perspective for different regions and affected countries. Detailed currency updates and analysis of IATA’s repatriation efforts are also available. The tool is updated as new information becomes available, supporting Members’ efforts to manage their foreign exchange repatriation and the associated risks to make informed decisions.

More information about this tool is available on the IATA Currency Repatriation webpage.

For access and any reporting queries, Airlines can contact IATA at currencycenter@iata.org.