Total passengers set to double to 7 billion by 2034

Government policies can counteract economic headwinds

- Seven of the ten fastest-growing markets in percentage terms will be in Africa. The top ten will be: Malawi, Rwanda, Sierra Leone, Central African Republic, Serbia, Tanzania, Uganda, Papua New Guinea, Ethiopia and Vietnam. Each of these markets is expected to grow by 7-8% each year on average over the next 20 years, doubling in size each decade.

- In terms of routes, Asian, South American and African destinations will see the fastest growth, reflecting economic and demographic growth in those markets. Indonesia-East Timor will be the fastest growing route, at 13.9%, followed by India-Hong Kong (10.4%), Within Honduras (10.3%), Within Pakistan (9.9%) and UAE-Ethiopia (9.5%)

“The demand for air transport continues to grow. There is much work to be done to prepare for the 7 billion passengers expected to take the skies in 2034,” said Tony Tyler, IATA’s Director General and CEO.

“Economic and political events over the last year have impacted some of the fundamentals for growth. As a result, we expect some 400 million fewer people to be traveling in 2034 than we did at this time last year. Air transport is a critical part of the global economy. And policy-makers should take note of its sensitivity. The economic impact of 400 million fewer travelers is significant. Each is a lost opportunity to explore, create social and cultural value, and generate economic and employment opportunities. It is important that we don’t create additional headwinds with excessive taxation, onerous regulation or infrastructure deficiencies,” said Tyler.

Divergence among the BRIC Nations

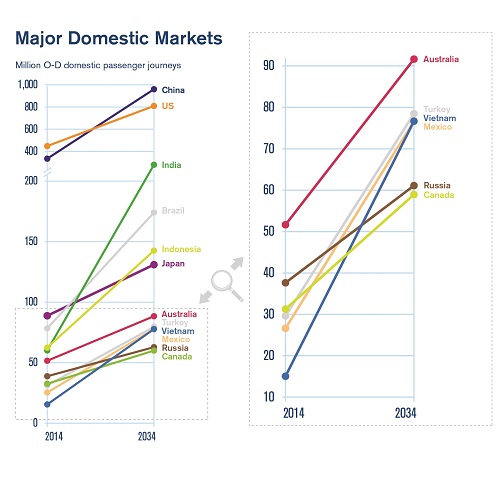

A sizable gulf has opened up between the performance of air passenger markets in the BRIC economies (Brazil, Russia, India and China). China and India are growing fast, with annual growth this year-to-date of 12.5% and 16.5% respectively. India has bounced back from a subdued 2014, and is seeing a strong increase in domestic frequencies. Although China’s growth rate has moderated, it is still on course to add an additional 230 million passenger journeys between 2014 and 2019. This is more than double the other three BRIC nations put together. Brazil and Russia, by contrast, are struggling. Falling oil and other commodity prices are partly to blame. Economic sanctions have also affected the Russian economy. It is notable that airlines in Brazil pay some of the highest fuel charges in the world; bringing the country’s fuel policy in line with global standards would certainly be a boost for air transport.

Exciting prospects for Iran and Cuba

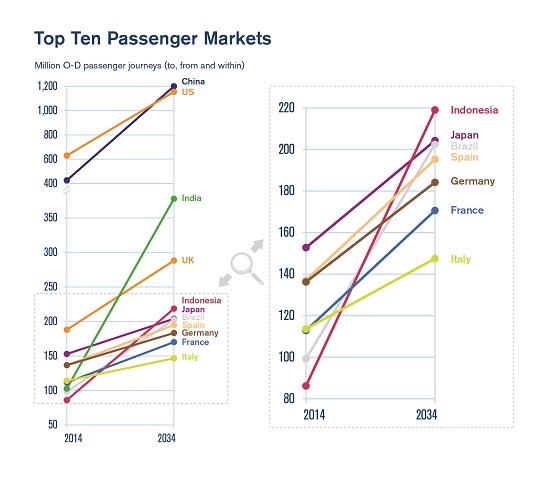

Trends in the 10 largest air passenger markets

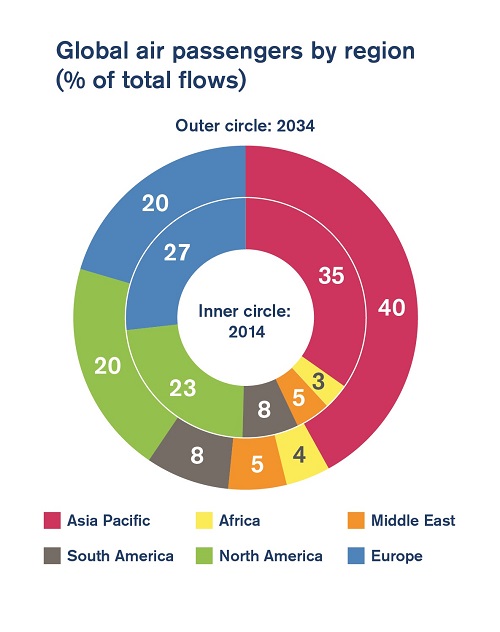

- Routes to, from and within Asia-Pacific will see an extra 1.8 billion annual passengers by 2034, for an overall market size of 2.9 billion. In relative terms it will increase its size compared to other regions to 42% of global passenger traffic, and its annual average growth rate, 4.9%, will be the joint-highest with the Middle East.

- The North American region will grow by 3.3% annually and in 2034 will carry a total of 1.4 billion passengers, an additional 649 million passengers a year.

- Europe will have the slowest growth rate, 2.7%, but will still cater for an additional 591 million passengers a year. The total market will be 1.4 billion passengers.

- Latin American markets will grow by 4.7%, serving a total of 605 million passengers, an additional 363 million passengers annually compared to today.

- The Middle East will grow strongly (4.9%) and will see an extra 237 million passengers a year on routes to, from and within the region by 2034. The UAE, Qatar and Saudi Arabia will all enjoy strong growth of 5.6%, 4.8%, and 4.6% respectively. The total market size will be 383 million passengers.

- Africa will grow by 4.7%. By 2034 it will see an extra 177 million passengers a year for a total market of 294 million passengers.

Economic prosperity and environmental responsibility

- 1.5% annual fuel efficiency improvement to 2020

- Capping net emissions through carbon-neutral growth from 2020

- A 50% cut in net emissions by 2050, compared to 2005.

“Aviation is determined to achieve carbon neutral growth from 2020. But we need governments to help by agreeing a global market-based measure, to be implemented from 2020. We believe that a global carbon offsetting scheme would be the best option, but the decision rests with the 191 member states represented at the International Civil Aviation Organization, who will meet in late 2016. We urge all governments to agree a global solution and help air transport meet its goals for a sustainable future,” said Tyler.

Corporate Communications

Tel: +41 22 770 2967

Email: corpcomms@iata.org

IATA Business Intelligence Services

Email: bis@iata.org

www.iata.org/pax-forecast

Notes for Editors:

- IATA (International Air Transport Association) represents some 260 airlines comprising 83% of global air traffic.

- All figures are provisional and represent total reporting at time of publication plus estimates for missing data. Historic figures may be revised.

- You can follow us at http://twitter.com/iata2press for news specially catered for the media.

- Explanation of demand drivers:

IATA’s Passenger Forecast Report, produced in association with Tourism Economics, analyzes passenger flows across 4,000 country pairs for the next 20 years, forecasting passenger numbers by way of three key demand drivers: living standards, population and demographics, and price and availability. - Living standards have a known effect on the propensity to fly. Countries on a growth curve up to approximately US$20,000 per capita see correspondingly faster increases in the number of flights taken per person per year.

- Population and demographics reflects not just population trends over the next 20 years but also measures such as the old-age dependency ratio. On these measures, countries such as Japan, Russia, and Ukraine are expected to undergo significant population decline. African nations, on the other hand, are set for rapid population growth. Typically, the nations with growing populations also have younger populations, and working-age groups are more likely to fly than over-65s.

- Price and availability looks to predict future trends of the price of air travel and the extent of future air connectivity. The unit cost of air transport has fallen by a factor of four since 1950. However, the past decade has seen prices bottom out, largely due to the increased cost of oil. In the coming two decades, the downward trend in the real cost of air travel is expected to resume, at a rate of around 1 – 1.5% per year. Air connectivity is expected to increase with the addition of new longer-range mid-size aircraft. Greater liberalization of air markets has the potential to increase global air traffic growth by over 1 percentage point per year.