Payment fraud has caused airlines to lose an estimated $1 billion annually1, which doesn’t include the impact to reputation, the cost of fraud prevention, or the cost to FFPs. The inconvenient truth is that airlines account for 46% of fraudulent ecommerce transactions2, more than any other market sector. Last year alone, fraud attacks grew by an astounding 61%3. How can airlines stop ecommerce fraud and ensure that customer experience and order conversion are not negatively impacted?

To combat this growing threat, 86% of airlines plan to implement 3D Secure, an industry standard protocol that authenticates cardholders and provides merchants with protection from fraud chargeback by providing a liability shift. Is 3D Secure the answer to the airlines’ growing fraud problem? The answer is a definite, “maybe.” Here’s why.

3D Secure has developed a reputation as a conversion killer, which can be true when 3DS is applied indiscriminately to all transactions. The goal of 3DS was never to inconvenience all customers as a precondition to stopping the bad guys. Fortunately, there is a better approach that can help airlines realize the benefits of 3DS without having to suffer the negative effects.

3DS should be viewed as one of the many fraud-fighting tools available to airlines and not as a silver bullet. Like any tool, it can be highly effective when used in the correct application. But 3DS is unlikely to deliver the results you are hoping to see when used carte-blanche.

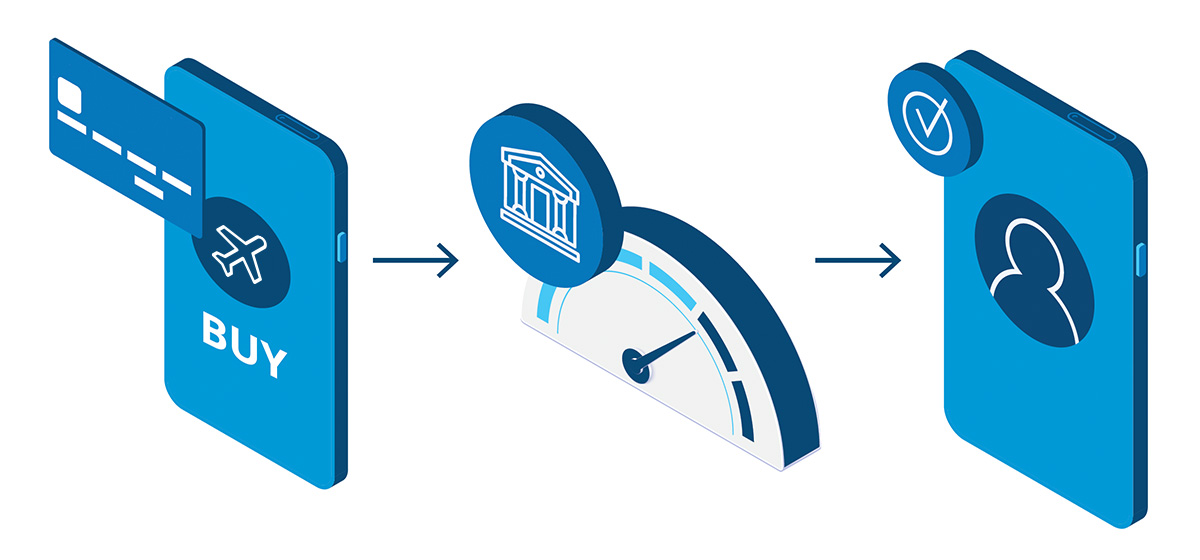

A more intelligent approach to the use of 3DS is required. The potential exists to improve conversion rates when 3DS is used as part of an orchestrated fraud management system that leverages artificial intelligence (AI), machine learning (ML), device fingerprinting, deep-link analysis, silent pending, behavioral analytics, and other cutting-edge technologies. In this context, 3DS isn’t required to shoulder the entire burden of stopping fraud, and in many scenarios, it isn’t required to be used at all. When 3DS is deployed, it is used strategically to authenticate transactions that might otherwise be declined. The result is higher payment acceptance and the confidence that your revenue is secure.

Read more on our blog on 3DS fraud strategy.

Vesta is a fintech pioneer in fraud protection and guaranteed payment technologies, helping online merchants optimize revenue by eliminating the fear of fraud.

Rodrigo Naranjo

Chief Growth Officer

Vesta

Sources:

1 Cybersource report conducted in collaboration with IATA and ARC

2 RSA Security and Juniper

3 Forter