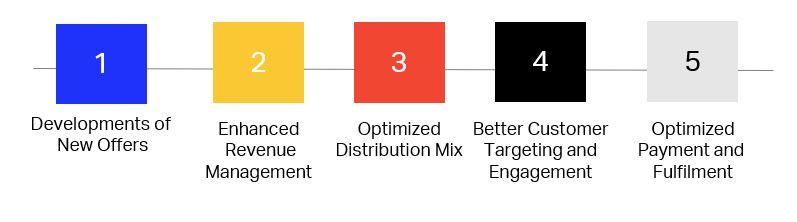

Airline Retailing creates value in 5 ways and by clicking on the tabs below you will find concrete success stories from industry players.

Presentations will be published regularly via this website. Presentations that illustrate benefits to the 5 points below are very welcome. Please contact us if you are interested to participate.

Development of New Offers

The development of new offers will create additional value and opportunities through new and richer content being made available to the end consumers. In a modern retailing world, airlines are more agile and can create dynamic bundles of products that will better fit customer’s needs. See some concrete examples below:

| New products and services |

|

| New corporate bundles |

Download their presentation (Nov 2019, BTN Webinar).

|

| 3rd party offering Carbon offset |

Anthony Rader, Director, Distribution Strategy, American Airlines

|

Enhanced Revenue Management

Enhanced revenue management strengthens customer analytics and retailing capabilities by implementing new revenue management solutions built on booking request context, leveraging deeper customer insights and demand drivers. This includes a new approach to total revenue management, optimization across all offer components and the introduction of dynamic pricing. See some concrete case studies below:

| Continuous pricing |

|

| Dynamic offers in revenue management |

|

Optimized Distribution Mix

Modern retailing also enables content differentiation by channel and the establishment of new partnerships with a broader landscape of partners. This results in the emergence of new business and partnership models in the area of airline retailing to better serve the customer. See some concrete examples below:

| Optimized distribution channels |

|

| New business models |

Important : IATA is not involved in airlines’ commercial strategies and model definition, but we do follow closely all public information in these areas in order to better understand their impact on standard adoption. |

| TMC focus on multi-sourcing |

|

Better Customer Targeting and Engagement

The journey to Airline Retailing is about moving to a world of Offers and Orders allowing airlines to sell products in new ways, directly to consumers. More specifically, retailing can create value and customer engagement, and stimulate new demand through new content and more relevant and tailored offers.

| Personalization |

|

| Better customer experience |

|

| Servicing |

|

| New itineraries |

|

| End to end NDC capabilities |

“Making sure that NDC content is showing without friction, alongside other content and works across all booking, reporting and duty of care products, has been underwhelming for our clients. Because there is no user impact.” Timmo Rol, Chief Product Officer AU/NZ, CTM Highlight: “NDC standard version 21.3 is the product of a decade of learning and experimenting. The industry to moving to this version will bring in the next phase of scale in airline retailing across the industry.” By Timmo Rol, Chief Product Officer AU/NZ, CTM Watch the TMC demo (April 2022). |

Optimized Payment and Fulfillment

| New methods of settlement between airlines and sellers |

|

|

|

| Finnair Travel Accounts Implementation in NDC |

|