The process of change, whether in politics, economics, society or business, continues to impact air transport. We interviewed Rafael Schvartzman, IATA’s Regional Vice President for Europe, to provide a 2025 review and share his expectations for European aviation in 2026.

On a global scale, we cannot fail to mention Safety, the industry’s number one priority. Unfortunately, 2025 served as another stark reminder that we must never let our guard down, as we witnessed various accidents including Air India Flight 171, the deadliest of the decade.

The ongoing terrible conflicts in Ukraine and the Middle East continued to affect operations with overflight restrictions and closures, causing infrastructure issues and impeding mobility and freedom of movement.

Less tragic but nonetheless important, trade wars became a norm, affecting air transport and adding extra strain to already severe major supply chain issues. The order backlog has surpassed 17,000 aircraft, a number equal to almost 60% of the active fleet. Historically, this ratio was steady at around 30-40%. This backlog is equivalent to nearly 12 years of the current production capacity. Meanwhile, the average fleet age has risen to 15.1 years (12.8 years for aircraft in the passenger fleet, 19.6 years for cargo aircraft, and 14.5 years for the wide-body fleet). with consequences on sustainability targets, capacity, as well as passenger experience and airfares.

In Europe, and Brussels in particular, the 2025 buzzword was “competitiveness”, surfing the Draghi report wave started the year before. It was also the overarching theme at the November Wings of Change Europe conference we organized for the first time in Brussels. We are still far from seeing Mr. Draghi’s vision, materialize and air traffic management remains a major headache for airlines and passengers, with important economic consequences.

Passenger and Cargo demand were on the rise, contributing to airline profits hitting record highs despite thin margins. A great example of this: Apple will earn more selling an iPhone cover than the $7.90 airlines will make transporting the average passenger.

Airlines are expected to achieve a combined total net profit of $41 billion in 2026 (up from $39.5 billion in 2025). While this would set a new record, the net profit margin is expected to be unchanged from 2025 at 3.9%. Net profit per passenger transported is expected to be $7.90 (below the 2023 high of $8.50, and unchanged from 2025).

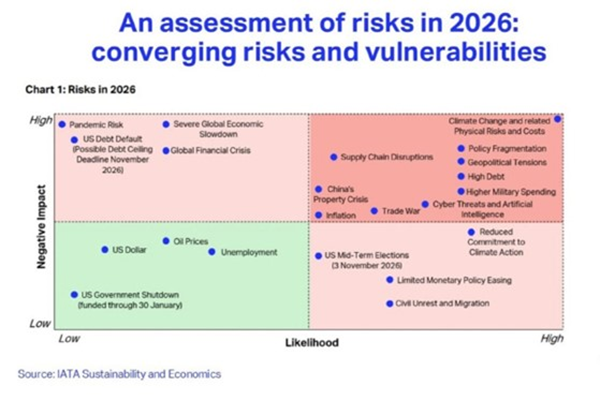

We have identified five major risks for Aviation in 2026, but also some opportunities. Firstly, on the policy side, the surge in protectionism and trade wars, overregulation and lack of harmonization in aviation, as well as fragmented and inconclusive tax policies offer few positive outcomes in terms of competition, prices, and sustainability.

Secondly, the supply chain challenge. We are witnessing aircraft order backlogs, and do not expect improvement until 2031–2034, which will continue to limit growth and hamper decarbonization efforts.

Thirdly, climate change. Instability has become a norm, taking the shape of extreme weather, commodity volatility, and agricultural impacts, which affect global trade and infrastructure. Meanwhile, decarbonization for airlines requires stable policies and solid financing, both of which are under strain.

Fourthly, the technology revolution. Cyberattacks are increasing in sophistication, amplified by Artificial Intelligence (AI) tools, which is an important threat as our industry relies on critical infrastructure, making it highly vulnerable. AI also introduces risks in misinformation, privacy erosion, job displacement, and inequality.

Finally, the macroeconomic outlook. The US dollar is expected to depreciate in 2026, benefiting non-USD economies by easing debt and trade costs. This is significant for aviation, as over 50% of costs are in USD. A severe economic slowdown seems unlikely, but the environment remains fragile, and policy mistakes are more likely.

Nearly 40% of IATA’s 368 members are based in Europe. In terms of serving the priorities of these European members, I will highlight four key issues:

Consumer rights are a massive concern for us. The revision of regulation EU261 is a crucial test for a more competitive Europe and we will continue to push for more pragmatism to improve connectivity and passenger service.

Air Traffic Management continues to be a real headache for all our member airlines, and not just those based in Europe, with delays doubling the past ten years… “The show must go on”, and so will our fight for modernization and efficiency gains.

Airport infrastructure and charges cannot be ignored. From capacity constraints to noise restrictions not following the balanced approach, we must ensure aviation continues to deliver benefits to passengers, economies and societies, which depend on a proper infrastructure. In parallel, infrastructure charges are also a major concern – this year we have important regulatory decisions on charges in Spain and the UK, to name just two.

Lastly, taxation. Governments are quick to tax airlines and passengers, a short-sighted solution as it will only reduce the ability of the economy to grow or improve productivity. Simultaneously, these taxes are counter-productive to decarbonize aviation, adding to the challenges encountered to deliver Fly Net Zero 2050.

Airlines’ sustainability priorities in Europe will continue to evolve around regulatory requirements all the while preserving competitiveness and connectivity. This involves an accelerated SAF deployment and developing a competitive supply market. IATA will continue to advocate for key enablers, a transparent and effective SAF market, a book-and-claim system, as well as more funding and incentives for SAF production.

From a regulatory perspective, we will prioritize the upcoming revision of the EU Emissions Trading Scheme (ETS), address our concerns with ReFuelEU, influence developments around the UK and Türkiye’s SAF mandates, and any other key developments across the region.

On a global scale, CORSIA operationalization and the upscaling the availability of the Eligible Emissions Units (EEUs) will remain critical. We must continue to emphasize that this remains the sole global system for international aviation, enabling increased harmonization.

Additional information: